How to Teach the Concept of a Budget

Aug 22, 2020

Our second topic of the Consumer Math Blog Series is about how to budget. Read more about why and how you can teach Budgets using my Budget Lesson Unit (click here to get your copy).

https://www.aloveforspeciallearning.com/consumermathweekly

https://www.aloveforspeciallearning.com/consumermathweekly

Purpose of Teaching Budgeting

I’m generally curious what exposure my students have to budgets before they step foot in my classroom (hence the 4 writing prompts on day 1). I have a feeling that the majority haven’t observed their family members (parents/guardians/siblings) developing the family budget or having to make hard choices and sacrifices to stay within that budget, because I think that most parents shield that type of decision making from their children (naturally). So, my belief is that most of my students have a very limited sense of what it means to budget money. This may look like only have $20 to go to the movies with friends that they were given as they walked out of their house when their friend arrived to pick them up.

In this $20 movie theatre instance (as it was for me as a teenager), the student doesn’t have time to PLAN for how to spend the money, RESEARCH the cost of the movie ticket and concessions, or ADJUST the plan to do everything they want to do within the set amount of cash. Let’s not even throw into the situation that a friend may loan them money to play that arcade game they love or offer to pay for a concession that they end up splitting.

Teaching the concept of a budget is a heavy load, but one that definitely needs to be lifted and pushed above one’s head!

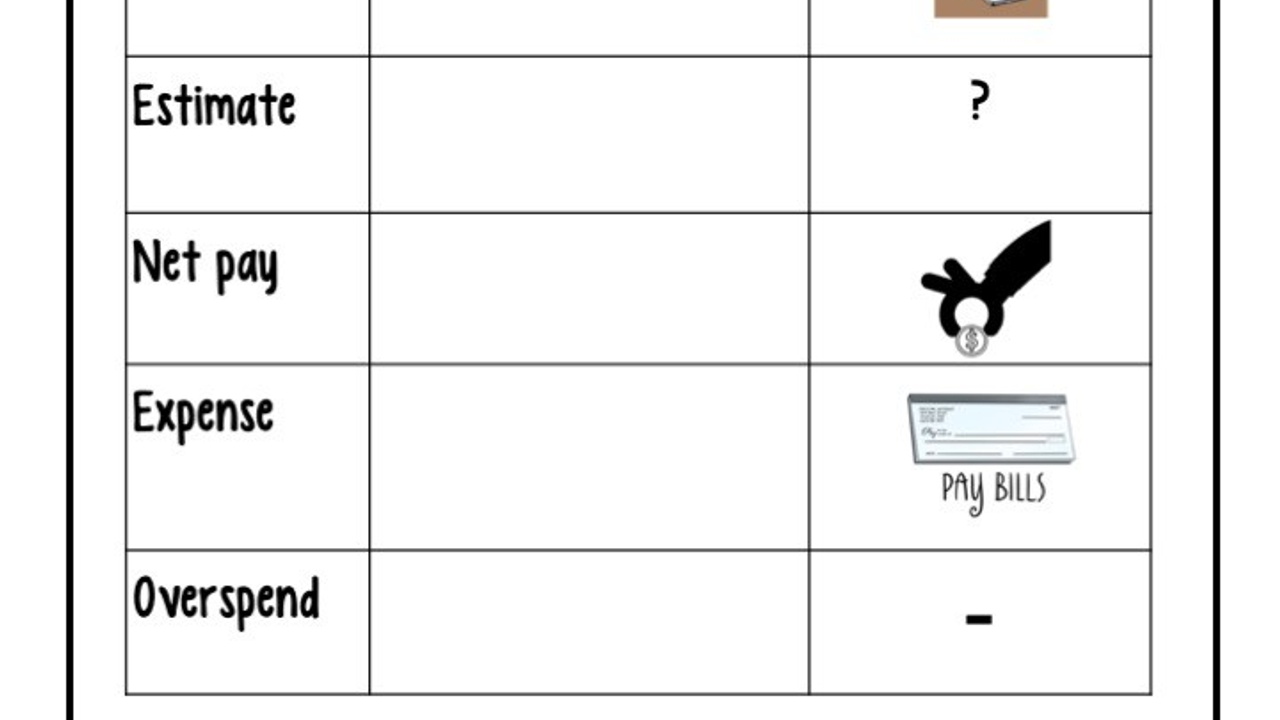

Key-Must-Teach Concepts

A budget can be any size from $1 to $1,000,000, but the idea of spending UNDER that amount is the same.

A budget is a plan! That means that there needs to be planning and thinking done BEFORE a purchase is made.

Self control is a real skill. Even though this isn’t explicitly stated in the lesson unit, it is a skill that must be both understood and exercised when you want to buy those $100 pair of jeans and your budget is only $20.

Budgeting takes adjustments. This hopefully should be a skill that is intertwined with the monthly budget worksheet (Big Budgets- Monthly). Students will have to see that they will need to spend less on one line item in order to afford the basics AND stay within budget.

Budget Lesson Unit

Lesson Objective

Create a budget plan for spending that is within a set amount of money.

Lesson Unit Break Down

Day 1- Throw out the brain teaser to the class and see how well your students can guess that budget (which we all can agree is an absolutely insane budget!). Refer to the Flow Chart and show how vital a budget is to spending and saving (which is a part of every other thing in life). This visual can help you to stress the importance of this lesson and why it is being taught so early in the school year- because it will be a part of basically every other lesson for the rest of the year! Then, complete the reading passage and writing prompt pages (see below for suggestions),

Day 2- It’s a notes day, lots of notes. Same old, same old. However, this is the time to show your personal budgets. I’ll bring in my personal budgets to show students that I actually budget as an adult who is much older than them. It’s important for them to see how this is a life-long skill.

Day 3- The ‘big budget’ worksheet is the focus of the day (along with any other notes you weren’t able to squeeze into Day 2). This is the time to get real with them! Talk about how much your electricity, cable, phone, rent/mortgage costs (or would cost) in your area. Some of the numbers will probably shock your students and that is a GOOD THING! Be open, honest, and help them understand the financial demands that require the need to budget. If you want to drive home this point, give each student 2-3 copies of the worksheet. Have 1 be what THEY think would be included in a monthly budget, have 1 be for a first draft as a class, and then have the 3rd (optional) be how they would mold and adjust their monthly budget to be what they want it to be.

Day 4- This day is for application practice! First there is an activity where each student will pull their own fate (a budget and a menu of items they can buy), this will get their budget minds flowing and help them decide perhaps what is a need and a want (also important when learning to budget). Then, this goes up a notch with the combination of budgeting, check writing, bill paying, and savings account. If you haven’t covered one of these areas yet, then just strike it from the overall project. It’s comprehensive and will help students to weave all these necessary skills together!

Day 5- Get one last review in with the task cards activity (see below), then have students complete the 5 questions assessment. Remember, there are two versions (one with open ended questions and one with multiple choice), so differentiate as needed! As students finish their test give them the word search. Throw up the answer key on the projector at the end for anyone who wants help or to check their answers. Then, call it a day!

Budget Lesson Unit

Reading Passage Options

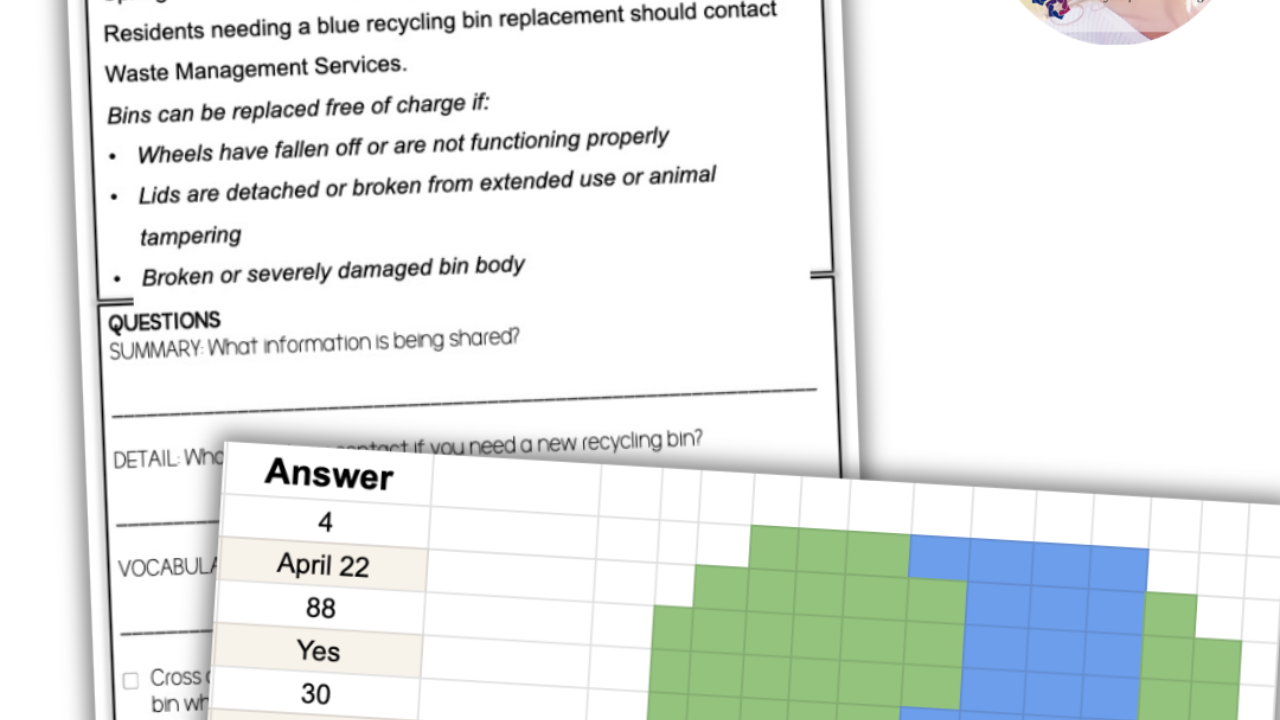

For the reading passage content, I would do the Read and Re-Read options. Give the students about 5 minutes to read the passage on their own, then read it aloud (or, better yet, have a Text-to-Speech Chrome Extension read it aloud) to the class. This will give students the input twice, once for their brain to begin to identify new terms and ideas and then to reiterate those terms and ideas for (hopefully) increased understanding.

After the reading I would suggest that students complete the 4 writing prompts. Save the 5 True/False questions until the start of the next class period, it will be a good review (or bell ringer) for them.

Listen and Learn

A Listen & Learn is a short, 5 sentence PowerPoint/Google presentation that introduces the topic using visuals and audio. Ideal for non-readers! Read about what they are and how they might be right for your classroom here.

Task Card Ideas

For the task cards, I’d suggest using the Circle Up method. Have students move their desks into one big circle, facing the wall (reduces talking and across the room shenanigans), give each student a card and a set amount of time to answer it (approx. 30 seconds- 1 minute). This will help to keep everyone at the same pace. Give the students the pre-filled answer key to cut down on time, if the bell is about the ring, because all the student has to do is just circle the right answer!

Further Practice Ideas

Albeit obvious, get in the bus and go somewhere to buy something! The options are really endless! Help the Foods and Nutrition class buy their groceries for the week (with coordination from the teacher and department budget overseers), buy flowers and donate them to a local retirement or rehab center, buy the supplies to make posters for an upcoming sports game at your school, use the money and go to lunch at a new/local restaurant.

Set the budget, make a plan, go out into the community, adjust the plan in real time, and then reflect. Do this as often as you can!

Ultimate Goal of the Lesson

The ultimate goal is to see that a budget is going to roll over into almost every other part of their life, so if they can hone and master this skill then so many other parts of their life (financial and otherwise) will be better for it. I think we all can agree that debt is stressful, being constantly late is in poor character (the budgeting of time), not having money for rainy days that will inevitably come can be overwhelming, and this can all be avoided by budgeting!

Budget Lesson Unit

May I Also Suggest Teaching

If you want to use the budget mindset correctly, then I suggest teaching this concept around the same time as Checking account, Savings account, and Income! They all go hand-in-hand with adult financial responsibility!