How to Teach Sales Tax

Oct 10, 2020

Our next topic in the Consumer Math Blog Series is about how to teach Sales Tax. Read more about why and how you can teach Sales Tax using my Sales Tax Lesson Unit (click here to get your copy).

Sales Tax Lesson Unit

Purpose of Teaching Sales Tax

The extra money that you are required to pay when making any purchase (from a candy bar to a car) will in some way go back to you. No, paying sales tax isn’t fun, but having a nice community resource, like a park or library, is and that is how these spaces get the money they need to be built and maintained.

Key-Must-Teach Concepts

It varies! Every community may pay a different amount in sales tax. Bigger cities tend to have higher sales tax % than smaller towns, it’s just the way it is. Sales tax percentages can vary from suburb to suburb and state to state.

The percentage is added, always! This can be confusing, especially when teaching discounts where the percent is subtracted or income tax where your paycheck gets smaller. Sales tax is always added!

Lesson Objective

Define and calculate sales tax for a given purchase.

Sales Tax Lesson Unit

Lesson Unit Break Down

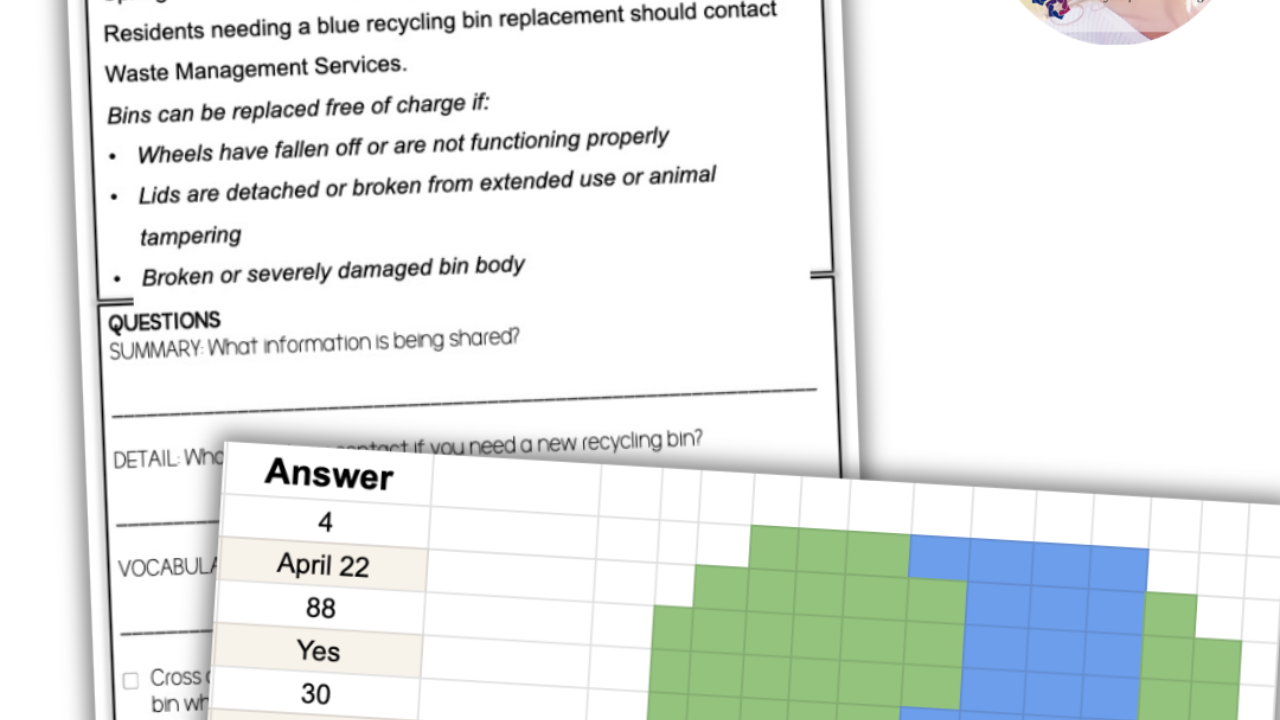

Day 1- Assuming most of your students have a vague idea of what sales tax is, day 1 should be pretty uneventful. Some students might be surprised to learn what sales tax funds pay for, but most should know that a $1.00 candy bar will cost them more than $1.00. With that said, start with the brain teaser (provide the answer whenever you like throughout the lesson or week), and then review the reading. See my suggestion (Reading Passage Option) below for how to add a little movement into the lesson for the T/F and writing prompt portion of the lesson.

Day 2- This is where the receipts will come into play (see below). Use these receipts after you have completed the notes and part worksheet to reiterate key vocabulary, like Sale, Added, Total, Percent. See if any receipts clearly list the sales tax % for the area or if there are any additional sales tax.

Day 3- Start the day’s lesson with a Quick Question about how sales tax impacts the price of a purchase. From there, you’ll move to the Sales Tax guided practice, which is the true example of guided practice. The problems set the student up for success and then gradually reduce the level of support as the student moves through the worksheet, ultimately ending with them completing a calculation from start to finish on their own.

Day 4- The powerpoint will make this day’s independent practice a slight bit more interactive. Students will work through different purchase prices and sales tax % to find the amount that is paid in sales tax and the total.

Tip: The powerpoint is FREE in my store, just find the FREE STUFF category on the left hand side!

Day 5- Review and assess is the name of the game for the day. Using a board game as a motivator, pair the task cards with each student’s turn (see below for more information). Then, each student can complete the assessment, answer their functional math questions, and enjoy a nice break with a word search!

Sales Tax Lesson Unit

Reading Passage Options

Twice is nice when it comes to reading. The more a student reads, the more they will absorb. So, if you can manage to get your students to read the passage twice then they will be better for it. Give the students a few minutes to read the passage on their own and then read it aloud to the class. Switch up the T/F questions by taking away the paper portion of this lesson. Put a line down the middle of the classroom (use tape on the group or mark two different sides on the whiteboard), then pose the question. Ask students to vote True by moving to one side of the room or False by moving to the other side of the room. Wrap it up by placing the worksheets for the writing prompts at the back of the room, have them swing by, pick one up, and then return to their desks to write. I think everyone will enjoy the brief movement break in the lesson!

Listen and Learn

A Listen & Learn is a short, 5 sentence PowerPoint/Google presentation that introduces the topic using visuals and audio. Ideal for non-readers! Read about what they are and how they might be right for your classroom here.

Task Card Ideas

Break out some board games and review! Any board game will do, just try to keep it brief! A student has to draw a task card and answer correctly before they get a turn. Copy a set for each small group of students and they can continue to re-use the same task cards throughout the game.

Further Practice Ideas

For a few days leading up to the lesson, ask your students to get pictures of the receipts they or their family gathers (or bring in the real thing). It will be nice to have an array of receipts to reference when finding sales tax and confirming calculation accuracy. Students will enjoy getting to use their ‘own’ purchases as examples in the lessons!

Ultimate Goal of the Lesson Unit

Students will hopefully come away knowing that the price of an item they want to purchase is not actually what they will pay. If they know to buffer in a few dollars for tax, then they will truly understand the concept of a budget AND sales tax!

Sales Tax Lesson Unit

May I Also Suggest Teaching

You may learn a new idea to two from these Consumer Math Blog Posts: