How to Teach About Savings Accounts

Sep 12, 2020

Our fourth topic of the Consumer Math Blog Series is about how to teach about Savings Accounts. Read more about why and how you can teach Savings Accounts using my Savings Account Lesson Unit (click here to get your copy).

Purpose of Teaching about Savings Accounts

A savings account should be opened long before a student has a checking account. Developing a savings takes time and should be a conscious action someone takes each time they earn money. This lesson unit covers the basics of savings accounts, the cumulative effect of saving, and how to save based on your gender.

Disclaimer- I use the Suze Orman suggested 10% for males and 15% for females (women typically earn less, thus the higher percentage) for the longest time. She has recently changed it to everyone should be saving 15%, so use your discretion as the educator and do what you feel is best for your students.

Key-Must-Teach Concepts

Save for the rainy day. No, there isn’t a real ‘specific’ reason to save money, you just need to do it. Yes, you can save for the hypothetical rainy day, but until you define what that might look like, this could be a challenge for some students to comprehend. I save for my overall Future. I save so that if something were to happen to my job, that I could continue my lifestyle for the next 6 months while I slowly looked for just the right position. I save so that I can go on vacation without feeling the guilt after returning. I save so that I can buy Christmas gifts at the end of the year and take advantage of the deals when they happen. Yes, I have different savings accounts for each of those Futures, but I don’t necessarily advocate you teach that method. Just keep on point with teaching that saving money is most important.

Self-control. Much like with budgeting, saving money takes a level of self control. This isn’t explicitly taught in the lesson unit (because, it is a character trait after all), but it is something that can be emphasized and naturally weaved into discussions.

Long term gratification. Similar to self control, this isn’t something you can truly show in your classroom, it has to be experienced first hand. However, you can talk about how difficult it was to save money for a big purchase or the feeling you had when you were able to pay for something big with cash. Sharing this may give your students a small glimpse into what it would be like to save money for long term gratification.

Savings Account Lesson Unit

Lesson Objective

Calculate a percent of a given amount to deposit/add to a savings account.

Lesson Unit Break Down

Day 1- Dive right into savings account on this day and cover all the ‘need to knows’ using the brain teaser (because it’s fun), the visual to show how things interconnect, and the reading passage (read below for a suggested way to execute).

Day 2- Notes on notes today. Start with the Notes pages and then work through the Parts worksheet. Yes, both are formatted in a ‘notes’ structure, but they move from general information to more detailed information. It’s a sit and get day for your students, but that doesn’t mean it's not meaningful or interactive because it’s definitely both!

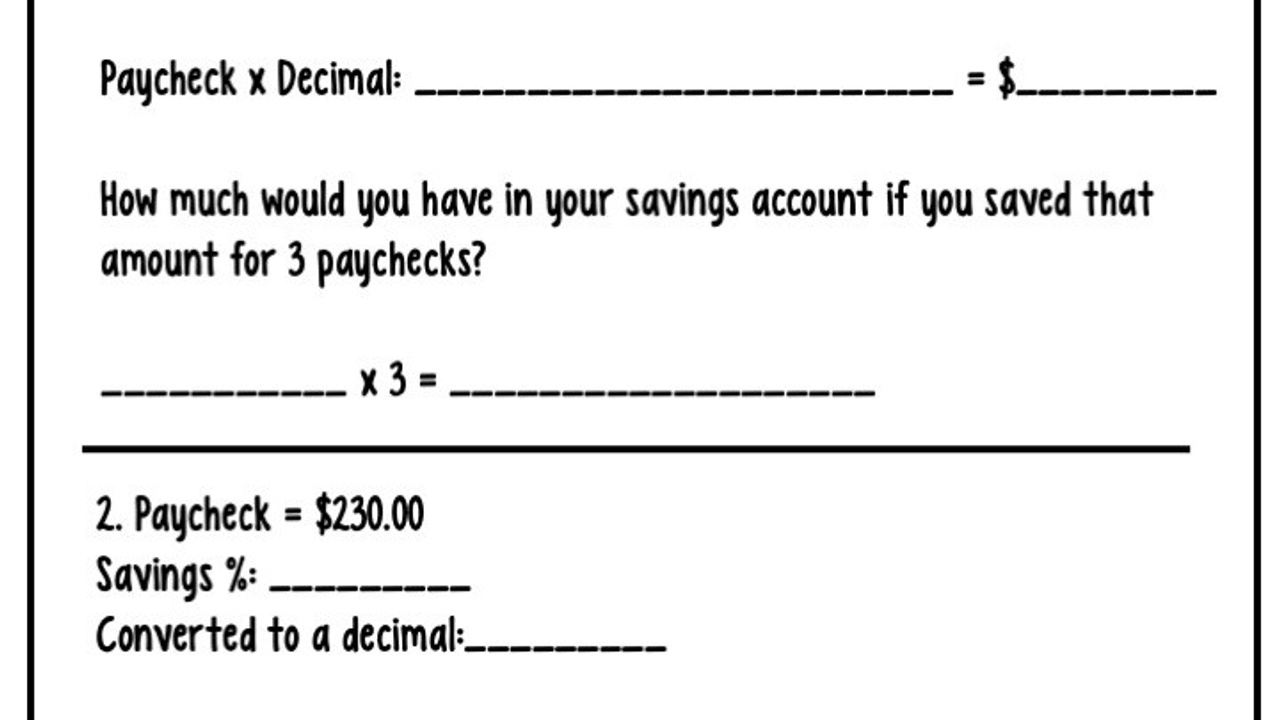

Day 3- The Savings Account Guided Practice sheet starts students calculating their identified % and then encourages them to calculate how much they would have if they saved that amount for both 3 and 6 months. Do you see how this will start them thinking about long term savings (remember that long term gratification I mentioned earlier).

This day is also a good day to show students how they can move money from a checking account into a savings account as there is a visual for this. If students utilize online banking, then this will be helpful in their understanding of the transfers.

Day 4- This is independent practice day and students will use a powerpoint (free in my TPT store) to calculate the savings of a hypothetical person. The savings calculation will be taken one step further as the student will need to calculate for 3 months, 6 months, and 12 months of saving. The hope is that they see the big pay off at that 12 month mark.

Tip- make sure each student has a calculator that isn't connected to the internet :)

Day 5- It’s review and ‘show what you know’ day. First, review all the concepts with the task cards (see suggested method below), then assess with the 5 question ‘test.’ As always, I like to hand out the word searches as students finish their test, it helps to keep the room quiet. Lastly, review those functional math skills either as a class, in partners, in small groups, or individually- you can’t go wrong with any method.

Savings Account Lesson Unit

Reading Passage Options

Give each student a highlighter or special colored marker/pen/colored pencil and have them mark 3 things that are new or ‘important takeaways’ while they read. I’d suggest giving them time to read on their own and then reading the passage aloud as a class (double the input, never a bad thing). Then, ask some students to share out what they underlined/highlighted and see if others agree.

Listen and Learn

A Listen & Learn is a short, 5 sentence PowerPoint/Google presentation that introduces the topic using visuals and audio. Ideal for non-readers! Read about what they are and how they might be right for your classroom here.

Task Card Ideas

Copy and cut enough versions of the task card so that each pair of students has a set. Have them do an Ellen version of ‘Heads Up’ with the cards. The pair of students face each other, one student puts one of the cards with a question on their forehead, the other person reads the card to them. This is where you can make it interesting- the person reading the card can give no choices or can offer the two choices at the bottom of the card. Then, switch so that the other student gets to review. Both students will get to review the concepts twice-which is way better than once and there is no need for an answer key. If both don’t know the answer, they should check their notes or ask a fellow set of partner pairs.

Further Practice Ideas

I have two suggestions of practice:

Give your students the option of creating a 1 week vacation somewhere (preferably domestic). Have them do some research about plane tickets, hotel costs, admission, food, etc. Then, tell them that they would have to save all that money BEFORE they went on the trip. That is what saving money is about. Save the money so that you can enjoy it in the future. Students can calculate how much money they could save per month and how many months they would need in order to afford the vacation!

OR

Tell your students that the money they spend on eating at restaurants (that includes quick stops to get a coffee, pop, or treat) will now need to go to their savings account instead. Have them write down how many times they went out to eat and approximately how much they spent on each visit in the past week, add that up, and multiply by 4 (average number of weeks in a month). Then, have them consider what they could spend that money on that would have a longer lasting effect on their life. A new phone? A better car if they continued to save? New coat? Gifts for their family?

Ultimate Goal of the Lesson Unit

The ultimate goal is to show that saving money is just as simple as spending it.

Savings Account Lesson Unit

May I Also Suggest Teaching

Since spending goes hand-in-hand with savings, I suggest checking out Checking Account and Budget Lesson Units.

If you want to take the concept of saving a little farther, then consider the Loan and Credit Card Lesson Unit which places emphasis on the importance of saving your own money versus borrowing someone else's funds.