How to Teach About Mortgages

Nov 07, 2020

Our next topic in the Consumer Math Blog Series is about how to teach Mortgages. Read more about why and how you can teach mortgages using my Mortgage Lesson Unit (click here to get your copy).

Purpose of Teaching about Mortgages

Students may hear their family talk about paying the mortgage, or see commercials about getting a mortgage, or know that a mortgage is something that helps you get a house, but they may not know the deeper layers of what it means to purchase a home and the responsibility that comes with paying a mortgage back. After knowing this, they may rethink uttering the phrase, ‘and then I want to buy a house.’

Mortgage Lesson Unit

Key-Must-Teach Concepts

A mortgage is a BIG commitment, both in terms of monthly financial obligation and length of time you have to sustain that commitment.

You should show proof of your ability to save big money! A down payment is a big part of getting a home (and a mortgage) so showing that you can save money for an extended period of time will help set the groundwork for paying a mortgage long term.

Lesson Objective

Explain the meaning and commitment of a mortgage.

Lesson Unit Break Down

Day 1- Take your time on this day because a mortgage will probably be a new or abstract concept for your students. Start with referencing the visual concept flow chart and then throw out the brain teaser. Then, jump to the Reading Passage. See the Reading Passage Option (below) for how you might want to use this resource for this topic. After the reading, use the T/F questions and writing prompts to round out the day.

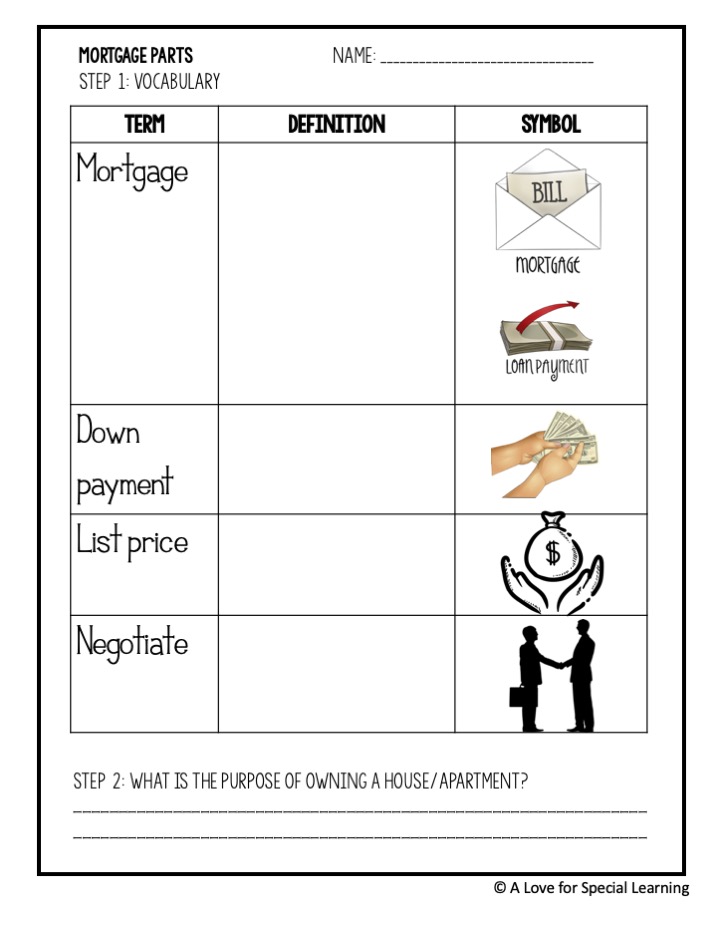

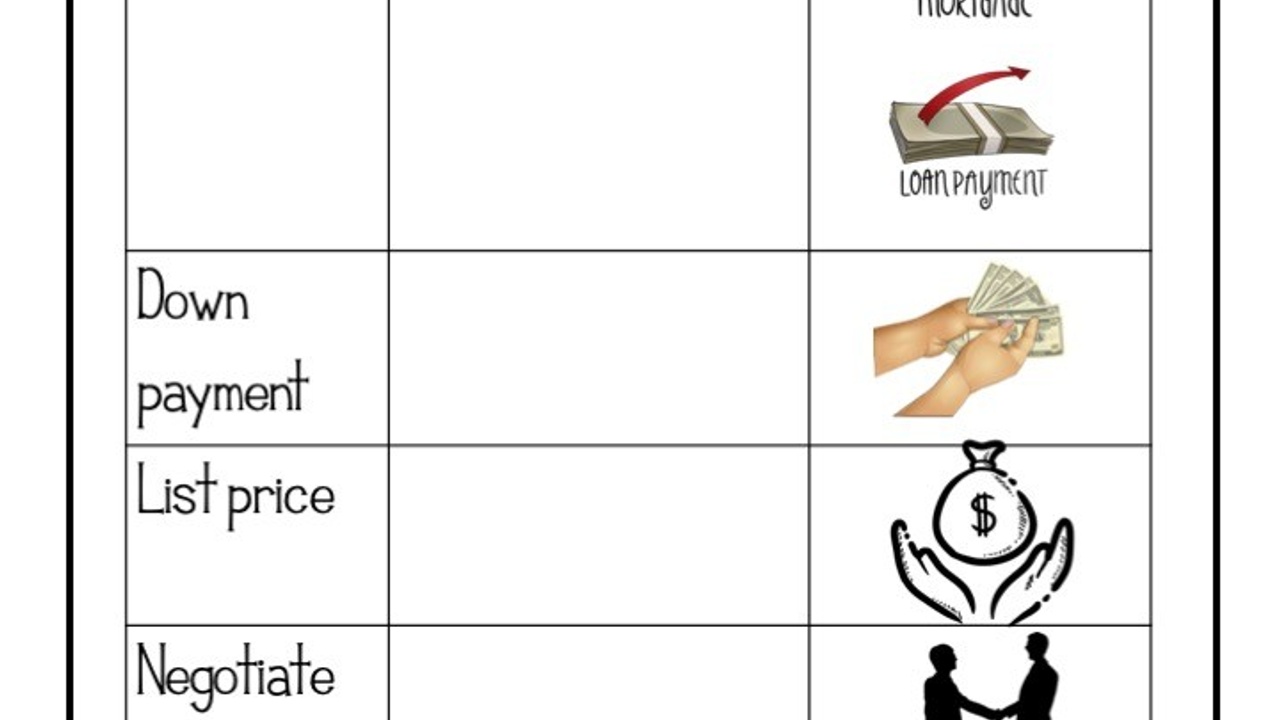

Day 2- Same old, same old. This day is dedicated to getting down to business, taking notes (both the Notes and Parts- see picture below). You will focus on the vocabulary, the idea of a mortgage, and review a property listing.

Day 3- This day is a full day! First, students will need guidance on deciding what features they want in a house. Then, students will jump on a realtor website (like Baird and Warner or whatever service is local to your area) and find 3 spaces (homes or condos) that best fit their priorities. Lastly, they will use the purchase price of their top pick and then calculate 20%. A down payment of 20% is most ideal and reinforces the concept of why you need to practice saving a large sum of money (like a mortgage payment) for a period of time BEFORE actually purchasing something.

Day 4- Students will follow a very similar format to Day 3’s guided practice for their independent practice. The additional step will be to identify pros and cons of the properties they are considering. This compare and contrast is a good skill to practice, especially when making a large purchase (or even renting).

There is an exit slip that can be used today or on Day 3, whichever suits your schedule best.

Day 5- Time to tackle the review task cards, assess, strengthen the functional math skills, and end with a fun word search! Check out the task card idea (below) for a different way to use the task cards.

Mortgage Lesson Unit

Reading Passage Option

There is a little space at the end of the reading passage and it can be used for re-writing the key points. May I suggest that your students identify 1 key piece of information from the reading and then shorten the sentence to a student-friendly worded phrase or sentence. For example:

-A mortgage is a really big loan of money that the bank gives you to buy a house.

-You have to pay it back every month for a long time, between 15-30 years.

-You have to be responsible or the bank won’t give you a mortgage loan.

Listen and Learn

A Listen & Learn is a short, 5 sentence PowerPoint/Google presentation that introduces the topic using visuals and audio. Ideal for non-readers! Read about what they are and how they might be right for your classroom here.

Task Card Idea

Do you remember the ‘Around the World’ game (I played in elementary school)? Two students would stand next to each other (usually besides one of their desks) and the teacher would flash a card at them (usually math facts, like multiplication) and the first to answer correctly would move to the next student’s desk. Does that ring a bell to you?

Try that concept, except instead of showing the flash card for only the two students could see (and those sitting close by), try projecting it on a screen for everyone to see. This will increase everyone's engagement as they want to see who answers correctly. May I recommend you don’t show the answers at the bottom? Or, consider showing the answers for 1 go around and then don’t show the answers for the 2nd go around.

Mortgage Lesson Unit

Further Practice Idea

This is more fun than applicable, but why not have a little fun! Use Zillow.com to find the most expensive house in your school’s zip code area. Then, put that purchase price in a mortgage calculator and watch the eyes widen! If you want to get crazy, have the students divide that cost by your state’s minimum wage and try to figure out how many hours someone who made minimum wage would have to work to pay that monthly mortgage. Remember, that is before income tax is taken out and, depending on the price, it might not even be possible to work to pay that mortgage each month!

Ultimate Goal of the Lesson Unit

The ultimate goal is to drive home the level of responsibility and commitment that comes with a mortgage. If students can begin to fathom the cost of a monthly mortgage and that they would have to pay that amount between 180 and 360 times, then they really understand the concept and gravity of a mortgage.

Mortgage Lesson Unit

May I Also Suggest Teaching

Since a mortgage loan won’t be in your students immediate future, I’d also suggest teaching Rent around the same time.