How to Teach about Loans and Credit Cards

Jan 02, 2021

Our next topic in the Consumer Math Blog Series is about how to teach Loans and Credit Cards. Read more about why and how you can teach Loans and Credit Cards using my Loan and Credit Card Lesson Unit (click here to get your copy).

Students will have heard about loans and credit cards from their family or seen commercials for both while watching TV, however neither probably get into the nitty gritty of what it means to have a credit card or to be actively paying back a loan. The purpose of this lesson unit is to bring to light the meaning of a loan/credit card, the responsibility associated with both, and the additional financial cost they can have.

***Depending on who’s financial thoughts you subscribe to, some believe building credit is a good thing (Suze Orman) and some see it as a less important thing (Dave Ramsey). Regardless of how you may personally feel, students should understand what loans and credit cards are, how they work, and how it can show a level of marked responsibility.

They are a responsibility! Both require daily/weekly monitoring, the ability to remember to make payments, and the willingness to make them a priority to your personal budget.

Saving is always an option! Since both will require long term responsibility and (most likely) interest payments, it may be more advantageous to save the money rather than use a credit card or loan.

Loan- Calculate the final cost of a loan with interest using an electronic calculator or website.

Credit Card- Calculate the final cost of a credit card purchase with interest using an electronic calculator or website.

LOAN

Day 1- Use the flow chart to show the topics for the next few days. Hold off on the brain teaser until Day 3! Cover the reading passage (see idea below), and then dive into the T/F questions and writing prompt. Keep the momentum going with the Notes pages!

Day 2- Today will be a full day! Start off by getting into more details about Loans with the Parts worksheet. Then, shift over to the Loan Calculation worksheet. This can be completed individually or as a class. Students will use the internet to find the cost of an item and then use an online calculator to find out the monthly loan and overall cost of making a purchase using a loan.

CREDIT CARD

Day 3- Go ahead and give them the brain teaser (and answer- if you like). Then, revisit any T/F questions or writing prompt questions you like before heading into the basics using the Notes page.

Day 4- Students will use the internet to find a purchase price and then use an online calculator to find the cost of the monthly payment and how many monthly payments would need to be made to pay off the purchase if it was made using a credit card.

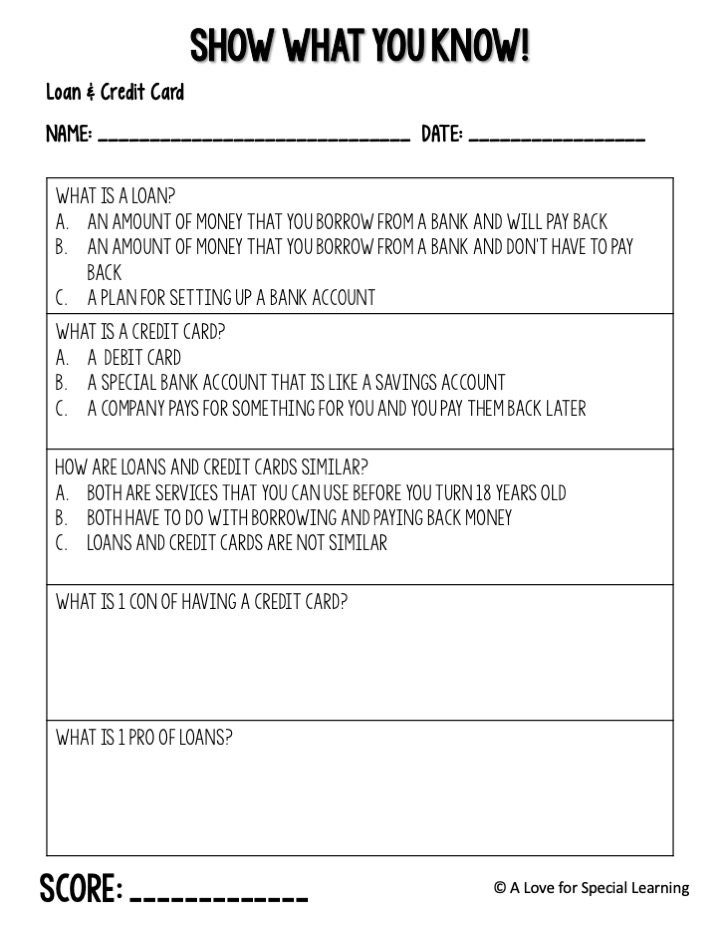

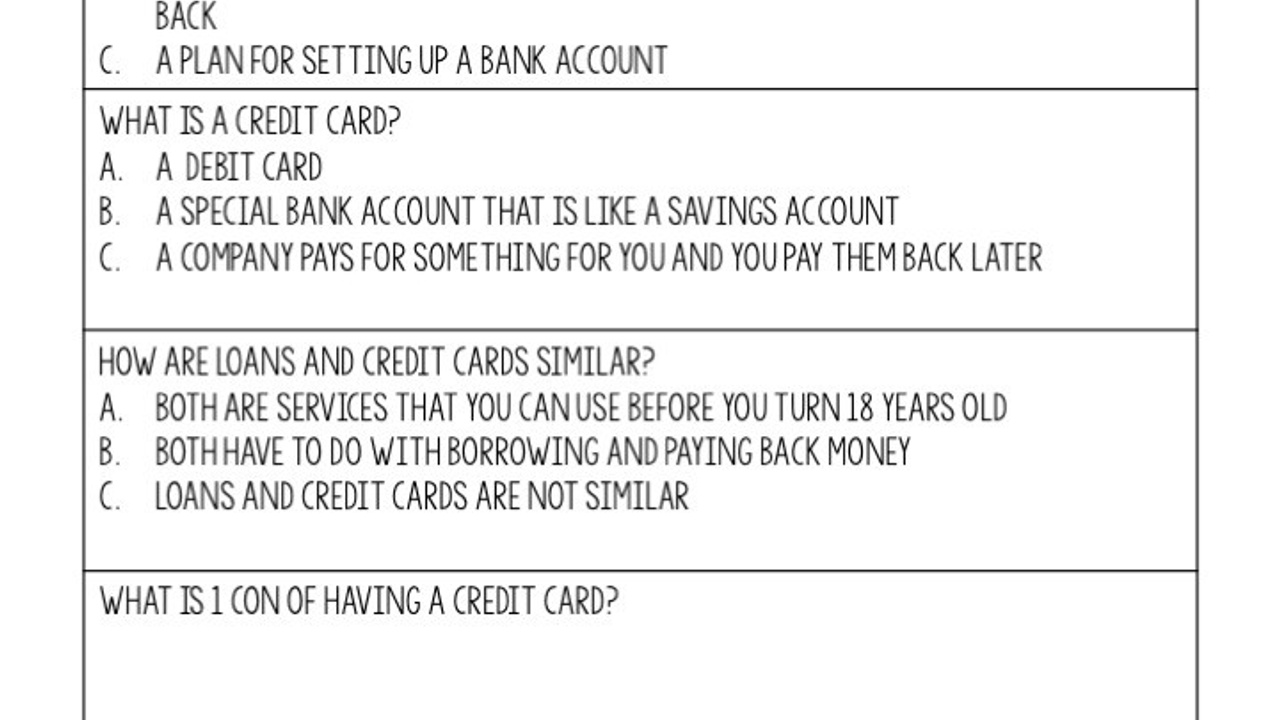

Day 5- Today brings both of those concepts together in a task card review (see suggestion below) and assessment (pictured right). The joint lesson ends with a word search and functional math review.

Take the reading and dissect it. Make a Venn diagram on the board (the two circles that cross over in the middle) and list how Loans and Credit cards are similar (middle cross over) and different (their own separate circles).

A Listen & Learn is a short, 5 sentence PowerPoint/Google presentation that introduces the topic using visuals and audio. Ideal for non-readers! Read about what they are and how they might be right for your classroom here.

Since there are two topics covered in this unit, the task cards are a combination of both topics. Split your class into two groups and have them focus on one topic (loan or credit card), then have them only answer the questions that have either Loan or Credit Card in the question. Then, switch! Place the cards around the room for lots of movement!

Loan and Credit Card Lesson Unit

If you want to open your students’ eyes of the sad reality of credit card debt, then consider using this article as a conversation starter:

Ultimate Goal of the Lesson Unit

May I Also Suggest Teaching

The goal of this lesson is for students to see that borrowing money will cost money. No matter if the borrowing is temporary (credit card) or long term (loan), it costs money to have someone ‘give’ you all the money you want/need upfront. If they see this as an additional cost to a purchase/loan, then the goal has been met!

Loan and Credit Card Lesson Unit

The two topics are brought together for one unit lesson because the concepts are so similar, therefore they work nicely together. Since you can get both a credit card and a loan from a bank, consider also teaching Bank Services so students can delve deeper into the other services that banks can provide.

You may learn a new idea to two from these Consumer Math Blog Posts: